Step-by-Step Guide: Making Use Of a Home Loan Calculator to Plan Your Mortgage Spending Plan

Step-by-Step Guide: Making Use Of a Home Loan Calculator to Plan Your Mortgage Spending Plan

Blog Article

Ingenious Financing Calculator: Equipping Your Budgeting Methods

Its influence goes beyond plain numerical computations; it plays a crucial function in monitoring one's financial health and, eventually, in maximizing budgeting approaches. This device's potential to revolutionize the way people browse their financial landscape is undeniable, offering a look right into a world where budgeting comes to be even more than just number crunching.

Comprehending Finance Alternatives

When taking into consideration obtaining money, it is vital to have a clear understanding of the different financing alternatives offered to make educated monetary choices. One usual kind of loan is a fixed-rate car loan, where the rate of interest stays the very same throughout the lending term, offering predictability in regular monthly repayments. On the other hand, adjustable-rate car loans have rates of interest that change based upon market conditions, offering the possibility for lower initial rates but with the danger of increased payments in the future.

An additional alternative is a secured finance, which calls for collateral such as a home or automobile to secure the obtained quantity. This sort of funding normally uses lower rate of interest because of the lowered danger for the lending institution. Unprotected lendings, however, do not require security but commonly featured higher rate of interest to compensate for the boosted threat to the lender.

Understanding these loan choices is essential in picking one of the most suitable financing option based on private demands and economic situations. home loan calculator. By evaluating the advantages and disadvantages of each sort of lending, customers can make well-informed choices that align with their lasting monetary goals

Determining Payment Schedules

To efficiently manage car loan settlement responsibilities, understanding and precisely calculating payment routines is critical for maintaining economic security. Determining settlement routines entails establishing the amount to be settled regularly, the regularity of repayments, and the complete duration of the car loan. By damaging down the total lending amount right into convenient regular payments, borrowers can budget properly and make sure prompt repayments, hence staying clear of late fees or defaults.

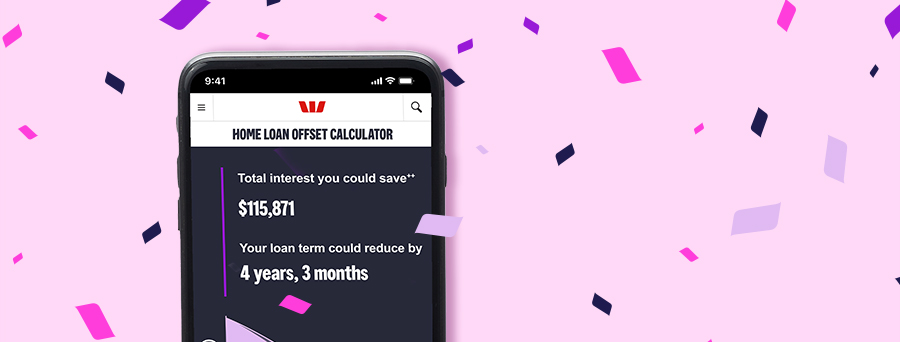

There are various techniques to compute settlement schedules, including using financing amortization routines or online funding calculators. Car loan amortization timetables supply an in-depth breakdown of each settlement, demonstrating how much of it goes towards the primary quantity and just how much in the direction of rate of interest. On the internet car loan calculators simplify this process by enabling users to input loan information such as the primary quantity, rates of interest, and lending term, generating a settlement timetable promptly.

Recognizing and calculating repayment schedules not just help in budgeting but likewise provide debtors with a clear review of their economic dedications, enabling them to make enlightened choices and stay on course with their payment responsibilities.

Surveillance Financial Health

Monitoring economic health involves routinely analyzing and examining one's monetary status to make sure stability and notified decision-making. By maintaining a close eye on crucial financial indicators, individuals can determine prospective problems at an early stage and take positive procedures to resolve them. One important element of keeping an eye on financial health and wellness is tracking earnings and expenses (home loan calculator). This entails discover this info here producing a budget plan, categorizing expenses, and comparing actual spending to the budgeted amounts. Disparities can signify overspending or economic mismanagement, motivating modifications to be made.

Routinely reviewing financial investment portfolios, retired life accounts, and emergency situation funds can aid people gauge their progression towards conference monetary objectives and make any type of required adjustments to enhance returns. Checking financial obligation degrees and credit history ratings is likewise important in assessing total financial wellness.

Maximizing Budgeting Approaches

In enhancing budgeting methods, people can take advantage of various methods to improve economic preparation and source appropriation effectively. visit site One key approach to take full advantage of budgeting approaches is via setting clear economic goals. By establishing particular goals such as conserving a certain amount monthly or reducing unneeded expenses, people can align their budgeting initiatives towards achieving these targets. In addition, monitoring expenses faithfully is critical in determining patterns and locations where changes can be made to optimize the budget plan better. Utilizing innovation, such as budgeting apps or monetary monitoring tools, can streamline this process and give real-time insights into spending practices.

In addition, focusing on savings and financial investments in the budget can assist individuals safeguard their financial future. By alloting a part of revenue in the direction of cost savings or pension prior to various other costs, people can develop a safeguard and job in the direction of long-term economic security. Seeking professional suggestions from economic coordinators or experts can likewise aid in maximizing budgeting methods by getting tailored guidance and know-how. Generally, by employing these strategies and remaining disciplined in budget plan monitoring, people can efficiently maximize their funds and attain their financial goals.

Making Use Of User-Friendly Functions

Verdict

Finally, the innovative loan calculator supplies a valuable tool for individuals to recognize car loan options, determine settlement routines, screen financial health, and take full advantage of budgeting methods. With straightforward attributes, this tool equips customers to make educated economic decisions and plan for their future financial objectives. By utilizing the lending calculator properly, individuals can take control of their funds and attain greater economic stability.

Monitoring monetary wellness includes regularly assessing and examining one's financial standing to make certain stability and notified decision-making. In general, by using these techniques and staying disciplined in budget plan monitoring, people can successfully enhance their monetary sources and achieve their monetary objectives.

In final thought, the cutting-edge finance calculator offers an important tool for individuals to recognize funding alternatives, determine repayment schedules, display monetary wellness, and make the most of budgeting methods. With user-friendly features, this tool encourages users to make educated economic decisions and strategy for their future financial goals. By making use of the finance calculator successfully, people can take control of their financial resources and attain greater monetary security.

Report this page